insurance company denied fire claim

The insurer though does have to offer an explanation for why your claim was denied. When you hire a public adjuster before you call in your damages to your insurance company we can prevent you from 2 things.

How Long Does It Take To Settle A Fire Claim Jt Legal Group

Every year there are tens of thousands of fires that are set intentionally.

. The property is underinsured. The insurance company not investigating your claim thoroughly enough. Build a strong case that includes your.

Late or missed premium payments give the insurance company reasons to deny your claim. It states that you must be notified of the acceptance or denial of your claim. Call 786 686-5045 or contact us online to book a consultation with a denied fire claim attorney today.

These are all extreme fire hazards and your claim will be denied promptly. This might mean that a particular type of fire isnt covered in your policy or it could mean that your policy only covers damage directly caused by flames and not damage due to smoke or the water from fire sprinklers. Damage values have been inflated.

Lack of documentation provided. If you need help with your Fire Damage Insurance Claim give us a call at the Claim Squad Public Adjusters. Our Florida Louisiana Mississippi and Puerto Rico insurance claims attorneys at The Morgan Law Group PA know that fire damage produces some of the most devastating results in homes and businesses throughout the country.

We will fight back if your claim has been denied or otherwise mishandled and help you secure the coverage you need and deserve after a fire. Arson intentionally set fire Fraud or Illegal activity. Keep copies of emails and take notes.

If the reason was suspected arson or some fault of yours that the policy lists in its exclusion provisions hire an. False Statements or Questionable Claims. You state you owned six television sets and the inspector finds evidence of four You may have to prove the contents you state that were.

Insurance claims for a house fire can be denied by the insurance company if they determine that your claim contains fraudulent information or the list of burned contents seems excessive. Something else that could happen here is that you receive only a payout for the value of the building itself. For a consultation with a property damage insurance lawyer in Los Angeles give us a call at 213-514-5681.

Policy information that shows the loss should be covered. The only thing that is potentially more damaging is the. You didnt receive a medical evaluation.

Not filing on time. Rebuttal to your insurance companys denial. If your insurance company has denied your Texas fire insurance claim you need to contact an attorney who handles fire loss claim denials at The.

If your insurance company suspects that arson might have caused a fire to start in your home. Find out what some of the reasons could be below. We here at Merlin Law Group exclusively.

If there are other ways that you couldve avoided the crash the insurance company might refuse to pay a claim. Saying the wrong thing to your insurance company that could result in a denial and if we believe your. Our experienced team of insurance claims lawyers are here to answer your questions communicate with the insurance company during the claims process and fight back against unjustly denied fire claims.

Fire insurance claims may be denied over errors made on a form or simply from lack of enough documentation that you are able to provide. Unpermitted work to the property. There are more steps involved depending on the nature and extent of the fire damage claim but this gives you an idea of how we would proceed.

Work was done without permits inspections If a fire is deemed to be caused by an electrical issue in a home where the electrical work was not permitted by the city or county where the home is located the insurance company will deny your claim. Elements for a Fire Damage Insurance Claim Lawsuit in Alabama. Some ideas to keep in mind include.

Insurance policy will require that you notify them promptly of any loss. Efforts to have your denied claim reviewed. Time-sensitive requirements for the filing and documentation of any claim.

Contact the best fire loss claim denial attorney in the country at The Voss Law Firm. Detailed evidence of the loss. Once your claim is denied the burden of proof is on you the insured to prove your loss.

Our instinct would be the same. Ask for Mike 754-252-5438. One of the top reasons that fire claims are denied is what insurers call insufficient coverage.

If an insurance company denied a fire claim for you they may have done it for any number of reasons. Whether youre currently considering suing your insurance company or not its always best to be prepared and keep detailed records. The insurance company is bound by law to abide by the outcome.

Once the report is complete submit it for the insurers review. You state you owned six television sets and the inspector finds evidence of four. Alabama Insurance Code Chapter 482-1-125 deals with standards for property and casualty insurance claims.

Our lawyers work to make sure you receive the compensation you deserve enough to help your business recover from the fire. Tips for Suing the Insurance Company for a Denied Claim. Call Insurance Claim HQ at 844 CLAIM-84 or or use our online form to request your free consultation today.

Insufficient evidence to support payments. You may have your claim denied or reduced. We take an aggressive approach in all our cases making sure you have a strong case to support your claim.

The best way to prevent your property damage insurance claim from being denied is to call a public adjuster first. Reason 3 House is Vacant at Time of Fire. Document any correspondence with the insurance company and its representatives.

The standard required of insurers is to be prompt and fair and to provide equitable settlements. Perhaps the cause was a fire flood storm burglary or vandalism. Below is a list of reasons your insurance company may give you for denying your claim.

Your home has suffered severe damage. In any case you believe you are covered file your insurance claim only to have it deniedYour first instinct probably involves cursing your insurance agent at the very least and we will not even consider the details of the worst. If the house has been vacant for more than 30 days and there were no signs of renovation occurring at the address the house fire insurance claim may be denied.

Reasons an Insurance Company May Deny Your Claim. Some injuries dont appear until days or. If you were in an accident its crucial to seek a medical evaluation immediately.

What are the Most Common Reasons Fire Damage Claims are Denied.

Fire And Smoke Damage Insurance Claims Lawyer Insurance Attorney

What Makes You Ineligible For Homeowners Insurance

Rhode Island Insurance Property Damage Attorney Palumbo Law

How To Sue Your Insurance Company For Bad Faith 4 Recent Florida Opinions Taylor Warren Weidner Hancock P A

Common Reasons Why Home Insurance Claims Are Denied Urban Northwest

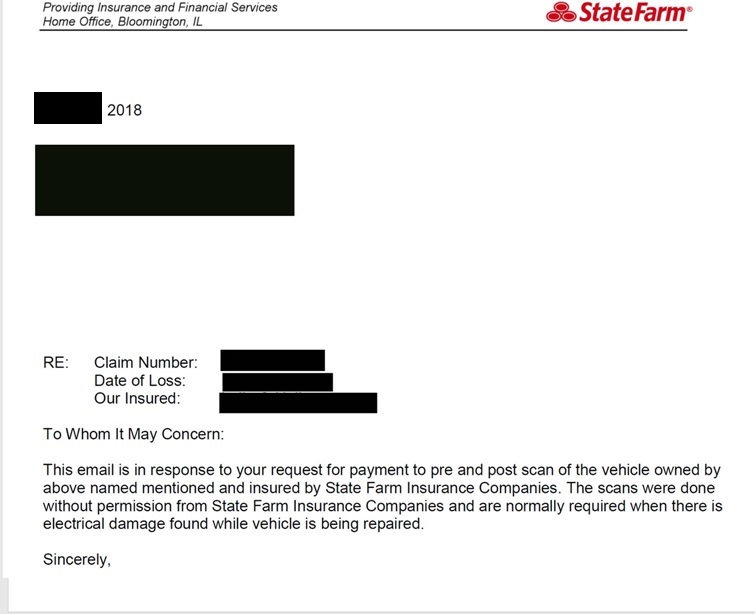

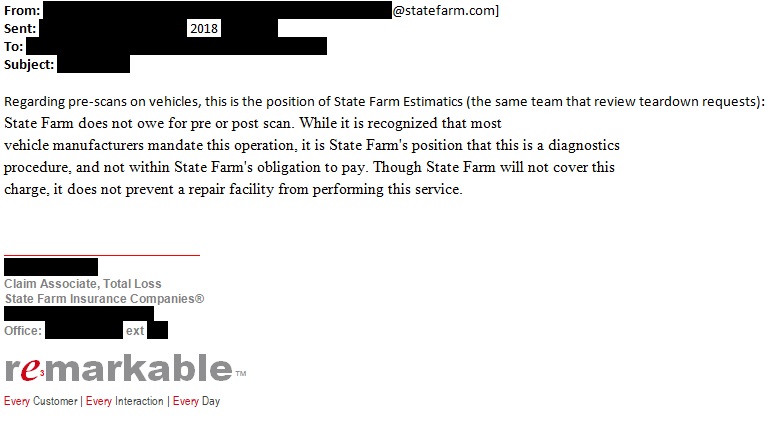

Following Premium Cuts Multiple Reports Of State Farm Denying Scans Repairer Driven Newsrepairer Driven News

Fire Damage Insurance Claim Lawyers Morgan Morgan Law Firm

House Fire Insurance Claim Help

Following Premium Cuts Multiple Reports Of State Farm Denying Scans Repairer Driven Newsrepairer Driven News

What To Do After A House Fire Insurance

What To Do After A Homeowners Insurance Claim Is Denied

Frozen Pipe Damage Homeowners Insurance Are You Covered The Voss Law Firm P C

Interpreting An Insurance Claim Denial Letter Wheeler Diulio Barnabei

How To Dispute Coverage Denial With An Insurance Company The Voss Law Firm P C

Reasons For Insurance Denial Of Fire Or Water Damage Claims Mirian Law Firm Blog

How To Appeal A Homeowners Insurance Claim Denial

Five Reasons Insurance Companies Deny Fire Claims

Five Reasons Insurance Companies Deny Fire Claims

Top 8 Reasons Car Insurance Claims Are Denied

0 Response to "insurance company denied fire claim"

Post a Comment